Hudson Public Risk specializes exclusively in municipalities, authorities, and governmental

operations—offering unmatched technical expertise, senior-level continuity, and a modern support

infrastructure designed for long-term public-sector stability.

A streamlined journey for cities, counties, school districts, public utilities, and public agencies.

Large brokers talk about resources—Hudson delivers them directly to the people who need them.

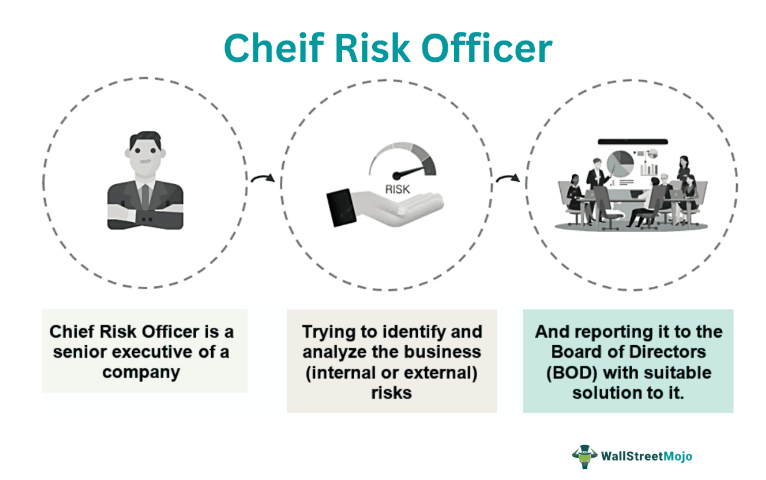

Our advisory team includes Georgia’s most experienced public-entity risk professionals, led by a President and Chief Risk Officer with unmatched municipal expertise.

Dedicated public-entity account managers, a professional back-office support unit, and a senior service executive ensure accuracy, compliance, and responsiveness across all operations.

We deploy advanced tools such as:

• Proprietary Risk Management Program / Technology

• InsurLink for document and policy interaction

• Claims-management support systems / Technology

• Public Risk compliance workflows

Our practice leader negotiates directly with underwriting leadership to secure sustainable, competitive programs for your municipality.

Georgia, Florida, Alabama, Tennessee, Texas, North Carolina, and South Carolina.

Strategic Leadership – We guide municipalities through long-term planning, three-year cost-containment

strategies, and structuring stable insurance programs.

Accurate processing, contract review, audits, and claims support all engineered for municipal operations.

We implement safety committees, provide onsite support, and work directly with leadership during critical events.

Your advisory team is senior, stable, and dedicated no turnover, no hand-offs, no loss of institutional knowledge.

For nearly two decades, I’ve had the privilege of working alongside the cities, counties, school districts, and public utilities that keep our communities strong. What has always mattered most to me is the relationship — taking the time to truly understand your challenges and being a partner you can rely on.

At T. Hudson Risk Advisors, we build insurance programs the same way we build trust: through clear communication, responsiveness, and solutions that fit the way your organization operates. With the support of a strong carrier network, we help you protect your property, manage liability, and take care of your employees through thoughtful workers’ compensation planning.

Thank you for the work you do every day. It’s an honor to support the people who serve our communities.

For nearly two decades, I’ve had the privilege of working alongside the cities, counties, school districts, and public utilities that keep our communities strong. What has always mattered most to me is the relationship — taking the time to truly understand your challenges and being a partner you can rely on.

At T. Hudson Risk Advisors, we build insurance programs the same way we build trust: through clear communication, responsiveness, and solutions that fit the way your organization operates. With the support of a strong carrier network, we help you protect your property, manage liability, and take care of your employees through thoughtful workers’ compensation planning.

Thank you for the work you do every day. It’s an honor to support the people who serve our communities.

Covers liability, physical damage, and statutory compliance requirements for public fleet operations including law enforcement, fire, EMS, sanitation, public works, and school transportation.

Ensures compliance with data privacy, breach reporting, and citizen-notification requirements. Protects critical systems from ransomware, breaches, and cyber extortion events.

Maintains compliance with federal civil rights statutes and Georgia legal standards related to force, arrest procedures, and detainee handling.

Provides foundational compliance protection for government facilities, infrastructure, public premises, and operations. Supports statutory risk-transfer obligations.

Supports compliance with governance, administrative conduct, ethics standards, and transparency laws. Protects boards, councils, and executive leadership.

Covers compliance exposures for employment actions, student rights, educational due process, and administrative decision-making.

Meets Georgia statutory requirements for employee injury benefits, wage replacement, and medical compensation with no deductible.

Provides mandated cancer and PTSD benefits for Georgia firefighters and first responders, ensuring statutory compliance and essential protective support.

Supports financial compliance, procurement integrity, and statutory bonding requirements for public fiduciaries and contractors.

Addresses EPA, Georgia EPD, and regulatory mandates associated with spills, pollutants, and environmental impacts.

Provides additional limits to ensure compliance with contractual indemnification and intergovernmental agreements.

Strengthens budget protection and meets insurer-required property valuation and replacement-cost standards.

Recommended for compliance with self-insurance or high-retention structures to protect against catastrophic injury losses.

Ensures compliance with pursuit protocols, high-speed chase standards, and liability arising from third-party injury claims.

Supports compliance with the Georgia Open Records Act and statutory retention schedules.

Assures compliance with OSHA, risk mitigation standards, emergency response protocols, and workplace hazard controls.

Supports compliance for major construction and renovation projects, ensuring proper coverage for municipal and educational builds.

Provides protection aligning with fiduciary responsibility requirements and financial controls.

Improves departmental oversight, compliance documentation, and HR defensibility.

Ensures uniform compliance with employee discipline processes and documentation standards.

Supports cybersecurity compliance, acceptable-use standards, and digital communication governance.

Creates compliance-aligned evaluation and development structures for defensible HR actions.

Strengthens compliance in areas of discrimination, harassment, wrongful termination, and retaliation claims.

Addresses compliance with emergency medical protocols, rendering aid, and standards of care.

Ensures compliance for safeguarding movable assets, tools, radios, and emergency response equipment.

Provides foundational HR compliance, workplace rules, required behavior standards, and administrative protocol.

Supports DOT, ADA, and transportation compliance for public transit and paratransit services.

Addresses compliance with service obligations, environmental discharge standards, and utility operations liability.

Ensures procurement transparency, financial control compliance, and audit defensibility.

Hudson Public Risk provides municipalities with a team structure unmatched in continuity, specialization, and operational capability. Every client receives direct access to senior leadership, a public-entity specialist, a dedicated service director, experienced analysts, and a full operational support unit.

This is the model large brokers cannot replicate.

The Public Risk division is supported by a dedicated five-person back-office unit trained exclusively for one year by the CEO and President on all municipal workflows, claims advocacy, documentation standards, and public-entity risk-management procedures. This team provides specialized administrative strength across every stage of the municipal service lifecycle.

They manage certificates and contract documentation, claims assistance, renewal data entry, audit preparation,

compliance workflows, and high-volume document processing. Their precision and reliability ensure that all

municipal requirements are handled accurately and on time.

By owning these critical operational functions, the Back Office Public Risk Support Unit enables senior advisors to

remain fully focused on strategy, risk management, carrier negotiations, and client stewardship—ensuring

municipalities receive both exceptional service and executive-level attention.

Todd Kohout is the Chief Executive Officer and Founder of Hudson Public Risk, where he directs the strategic vision, carrier relationship management, and long-term program architecture for municipalities and governmental entities across Georgia. With over two decades of experience in commercial insurance and risk management, Todd has built Hudson Public Risk into a specialized practice known for technical expertise, senior-level continuity, and direct access to underwriting decision-makers. He personally leads negotiations with insurance carriers to secure sustainable, cost-effective programs tailored to the unique exposures of public entities. Todd’s leadership philosophy centers on building stable, long-term client relationships backed by operational precision and proactive risk mitigation strategies.

Elizabeth E. Warren, ARM, AIS, serves as Practice Leader for the Public Entity Division at Hudson Public Risk and brings unparalleled depth of municipal risk management experience. As Georgia’s most experienced public-entity risk professional, Elizabeth leads compliance initiatives, safety committee development, crisis response coordination, and long-term stewardship programs for cities, counties, and authorities. Her expertise spans law enforcement liability, public officials coverage, workers’ compensation administration, and complex claims management. Elizabeth works directly with elected officials, city managers, and department heads to implement proactive risk mitigation strategies and ensure regulatory compliance across all municipal operations. Her leadership during critical incidents and crisis situations has earned her the trust and respect of public sector clients throughout the state.

Carla Schwinn serves as Director of Client Services for Hudson Public Risk, where she oversees the day-to-day service delivery, workflow management, and technology integration that supports municipal clients across Georgia. Carla manages the implementation and administration of InsurLink, the firm’s proprietary document management and policy interaction platform, ensuring that clients have seamless access to certificates, policies, and claims information. She leads the quality assurance process for all municipal service workflows, conducts regular service audits, and coordinates training for both client staff and internal team members. Carla’s operational leadership ensures that Hudson Public Risk maintains the highest standards of accuracy, responsiveness, and professionalism in every client interaction.

Christina Wright serves as a Public Risk Account Executive at Hudson Public Risk, providing dedicated account management and operational support for municipalities and governmental authorities. Christina manages the renewal process, coordinates policy changes, processes certificates of insurance, and serves as a primary point of contact for day-to-day service needs. She has developed specialized expertise in aviation-related exposures, supporting municipalities that operate airports, helicopter operations, and emergency medical transport services. Christina works closely with municipal finance directors, risk managers, and department heads to ensure timely processing, accurate documentation, and responsive service delivery throughout the policy lifecycle.

Trish Sanders serves as Senior Account Executive at Hudson Public Risk, specializing in contract review, coverage analysis, and compliance management for municipal clients. Trish conducts detailed reviews of vendor contracts, construction agreements, and lease documents to ensure proper insurance requirements and risk transfer language. She manages complex coverage questions, coordinates with underwriters on policy modifications, and ensures that all municipal exposures are properly addressed within the insurance program. Trish’s attention to detail and deep understanding of public entity exposures make her an invaluable resource for municipalities navigating procurement requirements, intergovernmental agreements, and contractual risk transfer strategies.

Trish Sanders serves as Senior Account Executive at Hudson Public Risk, specializing in contract review, coverage analysis, and compliance management for municipal clients. Trish conducts detailed reviews of vendor contracts, construction agreements, and lease documents to ensure proper insurance requirements and risk transfer language. She manages complex coverage questions, coordinates with underwriters on policy modifications, and ensures that all municipal exposures are properly addressed within the insurance program. Trish’s attention to detail and deep understanding of public entity exposures make her an invaluable resource for municipalities navigating procurement requirements, intergovernmental agreements, and contractual risk transfer strategies.