Specialized Insurance Solutions for Multi-Family, Mixed-Use, HOA, and Large-Scale Rental Operations

We combine insight, process, and responsiveness to deliver smarter coverage and measurable results. combining insights, process and responsiveness to deliver smarter covergae and measurable results

Understanding occupancy, tenant behavior, and building-level exposures.

Volume-leveraged programs reducing premiums and aligning coverage.

Profit-sharing platforms for companies with strong safety performance.

Strong carrier relationships for better terms and pricing.

Comprehensive risk management solutions tailored to the unique challenges of real estate portfolios and property operations.

We believe great partnerships are built through clarity, transparency, and aligned objectives. We work closely with property managers to protect assets, reduce exposure, and stabilize premiums.

We communicate proactively with you, your GC partners, your project managers, and your carriers to ensure seamless certificates, compliance, and claims support.

Multi-Family Residential Communities

Apartment Complexes

HOA & COA Associations

Townhome Communities

Mixed-Use Developments

Senior Living (Non-Medical)

Manufactured Housing

Mid-rise & High-rise Residential

Regional Property Management Firms

We bring an engineering-driven approach to property management risk—accurate data, disciplined submissions, strong carrier negotiations, and proactive communication.

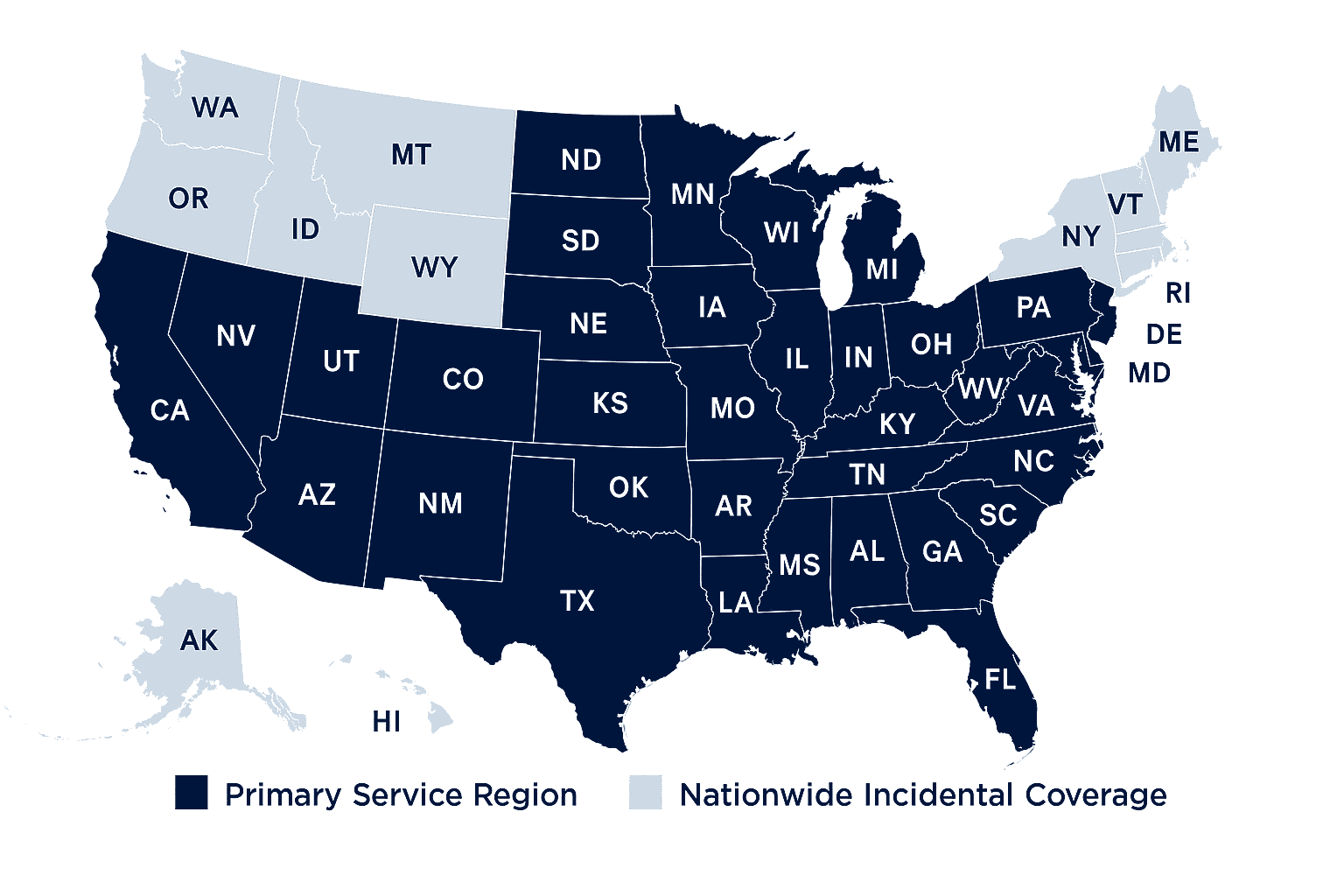

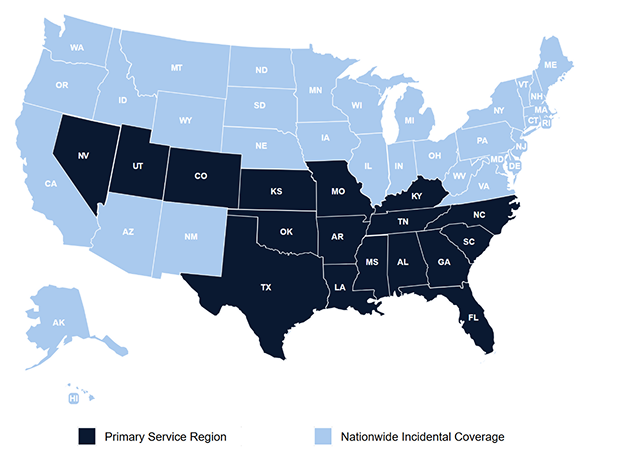

Primary Service Region with nationwide incidental coverage available for contractors and trades.

Choose the path that fits your needs. Whether you're exploring options, ready to schedule a call, or prepared to begin the onboarding process, we make getting started simple, clear, and comfortable.

T. Hudson Risk Advisors is licensed across the South and Southeast and can support incidental exposures nationwide for contractors and skilled trades.

Our primary service region is supported by active state licensing, with nationwide

incidental coverage available where permitted by law.

Choose the path that fits your needs. Whether you're exploring options, ready to schedule a call, or prepared to begin the onboarding process, we make getting started simple, clear, and comfortable.

T. Hudson Risk Advisors is an insurance advisory firm licensed across the South and Southeast, providing risk management and insurance solutions for organizations operating across multiple states. Our primary service region is supported by active state licensing, with nationwide incidental insurance coverage available where permitted by law and subject to carrier authorization and regulatory requirements.