T. Hudson Risk Advisors provides comprehensive commercial insurance solutions for businesses operating throughout the Southeastern United States. Our Property & Casualty insurance programs are designed to meet the needs of small, mid-sized, and large organizations seeking reliable protection, clear guidance, and long-term risk management support.

We proudly serve companies across Georgia, Florida, Alabama, Tennessee, Texas, North Carolina, and South Carolina, delivering tailored commercial insurance programs built around each client’s operations, exposures, and goals.

Property & Casualty insurance forms the foundation of a strong commercial risk management program. By working with a regional insurance advisor experienced across multiple states, businesses gain access to broader carrier networks, multi-state regulatory understanding, and consistent coverage structures for operations that span several locations.

Our P&C solutions address the most common and costly risks faced by businesses across the Southeast, including liability claims, vehicle-related exposures, property losses, and operational disruptions.

General Liability Insurance protects your business from third-party claims involving bodily injury, property damage, and advertising injury. Whether you operate a single retail storefront or manage multiple commercial locations across several states, General Liability provides essential protection for everyday operations.

General Liability Covers:

– Customer or visitor injuries

– Damage to client or third‑party property

– Personal & advertising injury

– Medical payments

– Legal defense costs

Commercial Auto Insurance protects vehicles owned, leased, or used by your business. With diverse driving conditions across the Southeast—from dense metro areas to rural commercial routes—businesses need Commercial Auto coverage that accounts for regional vehicle use, driver exposure, and state‑specific regulations.

Commercial Auto Covers:

– Auto Liability

– Collision & Comprehensive

– Uninsured/Underinsured Motorist

– Hired & Non‑Owned Auto

– Fleet Vehicle Programs

– Medical Payments & Injury Protection

Commercial Property Insurance protects the buildings and assets that support your operations. Businesses across the Southeast face property risks such as windstorms, lightning, theft, vandalism, equipment loss, and fire. Our programs ensure your physical assets remain protected so your business can recover quickly from unexpected events.

Commercial Property Covers:

– Buildings & Structures

– Business Personal Property

– Equipment, Tools & Furniture

– Inventory & Supplies

– Outdoor Signage & Exterior Fixtures

– Tenant Improvements

– Fire, Storm, Theft & Vandalism

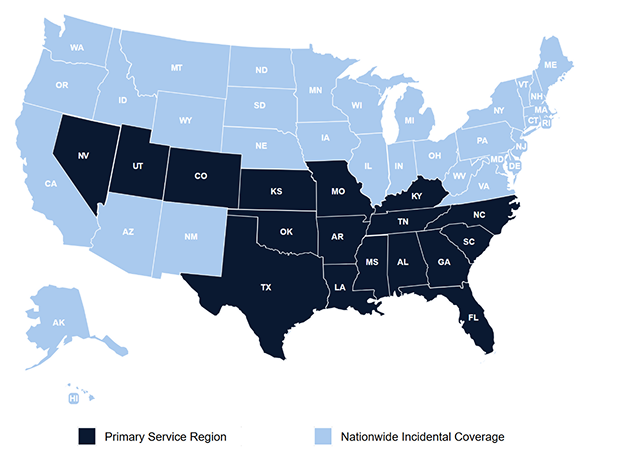

T. Hudson Risk Advisors delivers commercial insurance programs across the Southeastern United States. Our primary service regions include:

– Georgia (majority of our client base)

– Florida

– Alabama

– Tennessee

– Texas

– North Carolina

– South Carolina

We understand multi-state regulatory requirements, carrier appetites, compliance standards, and risk considerations unique to each market.

– Deep understanding of Southeastern markets

– Access to regional and national carriers

– Multi-state compliance support

– Consistent coverage structure across state lines

– Faster quoting and risk evaluation

– Relationship-driven guidance tailored to your operations

Whether your business operates in one state or across the entire Southeast, we design commercial insurance programs that protect your people, assets, and operations.