Specialized insurance programs tailored to courses, clubhouses, employees, amenities, guests, and high-value property exposures.

We combine insight, process, and responsiveness to deliver smarter coverage and measurable results. combining insights, process and responsiveness to deliver smarter covergae and measurable results

Deep understanding of member services, grounds operations, food service, tournaments, and guest liability.

Coverage for clubhouses, maintenance facilities, golf carts, equipment, and premium assets.

Experience reducing injuries among grounds crews, hospitality staff, and sports instructors.

Strong carrier relationships with specialized golf and hospitality programs.

Comprehensive risk management solutions tailored to the unique challenges of real estate portfolios and property operations.

We partner with golf and country clubs to protect members, guests, employees, and long-term financial performance through disciplined insurance program design and proactive risk management.

We communicate proactively with you, your GC partners, your project managers, and your carriers to ensure seamless certificates, compliance, and claims support.

Private Golf Clubs

Semi-Private Clubs

Public Courses with Expanded Amenities

Country Clubs

Resort Golf Courses

Pickleball & Tennis Complexes

Golf Academies & Training Centers

Multi-Amenity Club Developments

Retail Buildings

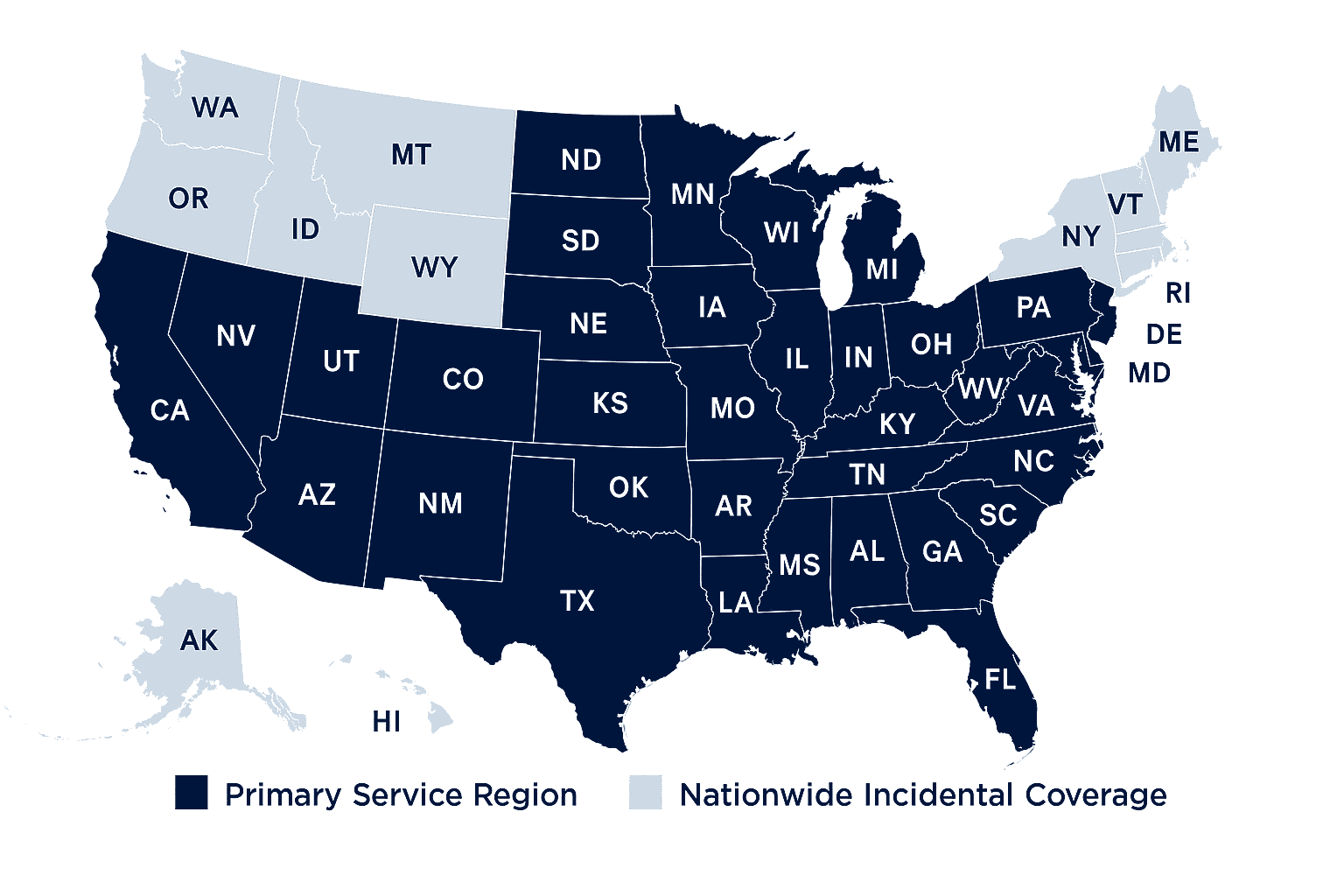

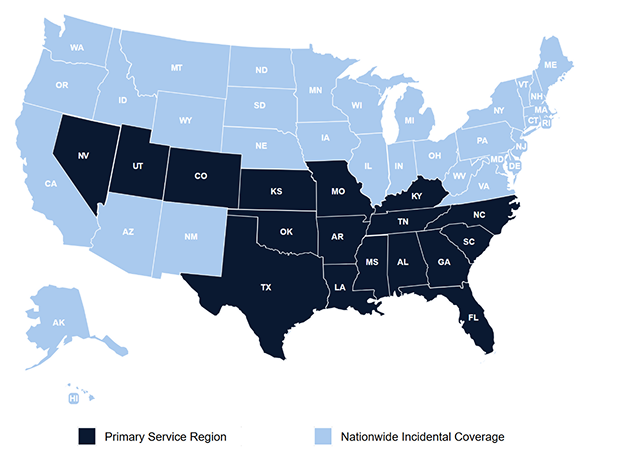

Primary Service Region with nationwide incidental coverage available for contractors and trades.

Choose the path that fits your needs. Whether you're exploring options, ready to schedule a call, or prepared to begin the onboarding process, we make getting started simple, clear, and comfortable.

T. Hudson Risk Advisors is licensed across the South and Southeast and can support incidental exposures nationwide for contractors and skilled trades.

Our primary service region is supported by active state licensing, with nationwide

incidental coverage available where permitted by law.

Choose the path that fits your needs. Whether you're exploring options, ready to schedule a call, or prepared to begin the onboarding process, we make getting started simple, clear, and comfortable.

T. Hudson Risk Advisors is an insurance advisory firm licensed across the South and Southeast, providing risk management and insurance solutions for organizations operating across multiple states. Our primary service region is supported by active state licensing, with nationwide incidental insurance coverage available where permitted by law and subject to carrier authorization and regulatory requirements.