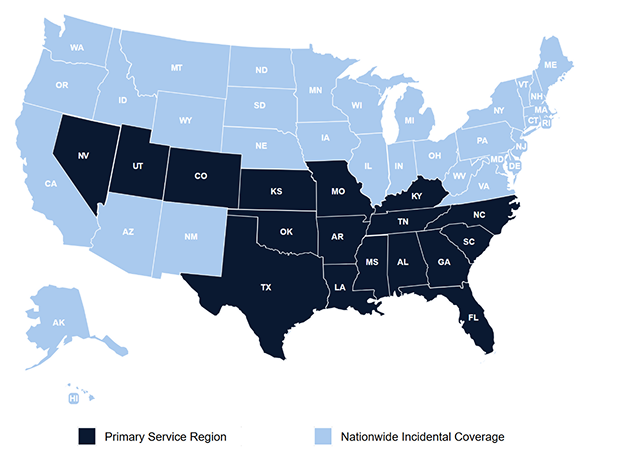

Builders Risk Insurance for Construction Projects Across the Southeast Protecting companies in Georgia, Florida, Alabama, Tennessee, Texas, North Carolina, and South Carolina.

Builders Risk insurance provides property protection for buildings and materials during construction or renovation. Coverage applies from ground-up construction through project completion

Buildings and additions in progress.

On-site, in transit, or stored off-site.

Interest, taxes, and architectural fees (by endorsement.

Scaffolding, forms, and fencing.

Protection against jobsite crime.

Lost income or financing costs from covered delays.

Industries We Protect:

Understanding First – We learn your operations and financial structure. Design & Placement – Policies structured accurately to avoid audit surprises. Ongoing Support – Managing estimates, classification updates, and renewal audits.

We learn how your business operates and what exposures exist.

We match your needs with the right carriers and design proper limits and endorsements.

Certificates, compliance support, contract review, and claims assistance year-round.

Why Businesses Choose T. Hudson Risk Advisors:

A: Limits depend on contracts, asset values, and risk profile.

A: Often required by lenders, contracts, or leases.

A: Industry, values insured, location, and loss history.

A: Yes, often packaged with other core policies.

Serving GA, FL, AL, TN, TX, NC, and SC.

Builder’s Risk Insurance protects construction projects across Georgia and the Southeast—including Florida, Alabama, Tennessee, Texas, North Carolina, and South Carolina. Whether you’re constructing a new building or renovating an existing structure, Builder’s Risk coverage safeguards your materials, labor, and investment from unexpected loss.

Builder’s Risk Insurance protects against major jobsite risks—fire, storms, theft, vandalism, and accidental damage. Most property policies exclude structures under construction, making dedicated Builder’s Risk coverage essential for any project in the Southeast.

First-Party Coverage Includes:

– Building materials, supplies & equipment

– Structures under construction or renovation

– Foundations, scaffolding & temporary structures

– Theft & vandalism

– Fire, lightning, windstorm, and hail

– Water damage (non-flood)

– Collapse during construction

– Debris removal

– Ordinance or Law (by endorsement)

– Soft costs & project delays

– Builder’s machinery/tools (optional)

Third-Party Coverage & Add-Ons Include:

– General Liability (project-specific)

– Contractor’s Equipment Coverage

– Installation Floater

– Contractors Pollution Liability

– Increased Limits for High-Value Projects

– Renovation / Remodel endorsements

– Delay in Completion coverage (soft costs)

Property Insurance Does NOT Cover:

– Structures under construction

– Renovations or additions

– Temporary structures

– Uninstalled materials

– Jobsite theft

– Weather damage during construction

Builder’s Risk DOES Cover:

– Construction in progress

– Renovations & remodels

– Materials stored on/off-site

– Theft, vandalism, fire, weather damage

– Soft costs & project delays

High-Exposure Industries Across the Southeast:

– General contractors

– Home builders & developers

– Commercial real estate investors

– Property owners & landlords

– Renovation contractors

– Municipal & infrastructure projects

– Subcontractors (electrical, HVAC, plumbing, framing)

– Multi-family & condo developers

– Tenant build-out firms

– Construction managers & design-build teams

We review project size, location, subcontractors, materials, and timelines.

We design a coverage structure aligned with project requirements.

We adjust limits, materials valuation, and timelines as your project evolves.

– Deep expertise in construction & development exposures

– Access to leading Builder’s Risk markets nationwide

– Fast quoting & accurate project valuation

– Clear guidance on complex multi-state requirements

– Proactive review of soft costs, timelines, and change orders

– Hands-on support from project start to completion