Insurance programs designed for garage operations, technicians, customer vehicles, tools, equipment, and on-site liability exposures.

We combine insight, process, and responsiveness to deliver smarter coverage and measurable results. combining insights, process and responsiveness to deliver smarter covergae and measurable results

Understanding labor risks, customer vehicle liability, and on-site safety challenges.

Carriers specializing in auto repair and garage operations.

Handling slip-and-fall, vehicle damage, fire, and theft exposures.

Reducing WC claims, shop accidents, and customer liability events.

Comprehensive risk management solutions tailored to the unique challenges of real estate portfolios and property operations.

We partner with auto body and repair shop owners to improve safety, protect employees, secure customer trust, and deliver multi-year premium stability through structured risk management.

We communicate proactively with you, your GC partners, your project managers, and your carriers to ensure seamless certificates, compliance, and claims support.

Auto Body Shops

Collision Repair Centers

Mechanical Repair Shops

Tire & Alignment Centers

Quick Lube Shops

Brake & Transmission Shops

Paint & Refinishing Centers

Fleet Service Garages

Custom & Performance Shops

We bring an engineering-focused, detail-driven approach to garage and repair shop risk—ensuring accurate valuations, clean submissions, strong safety programs, and proactive claims management that reduces downtime and loss severity.

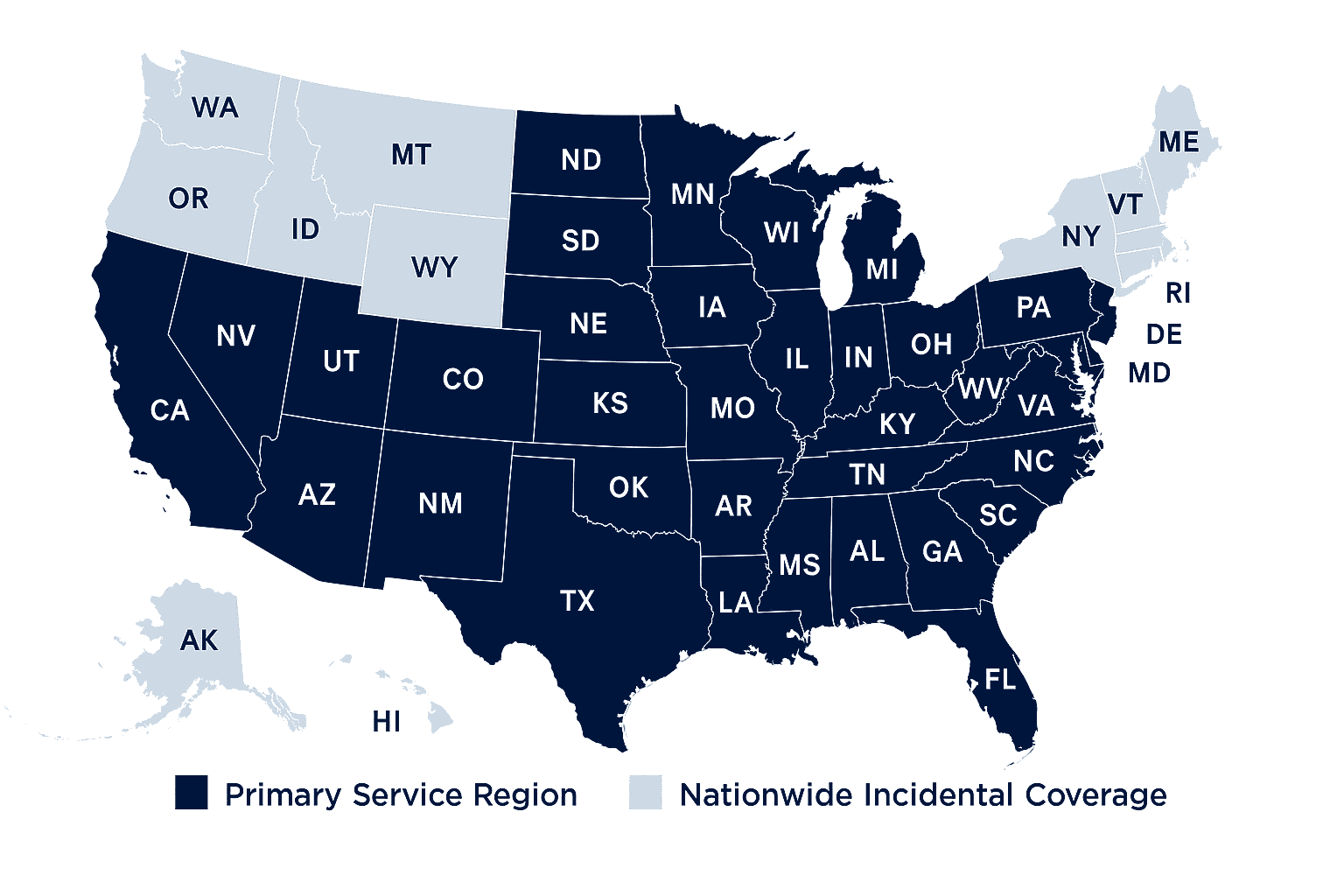

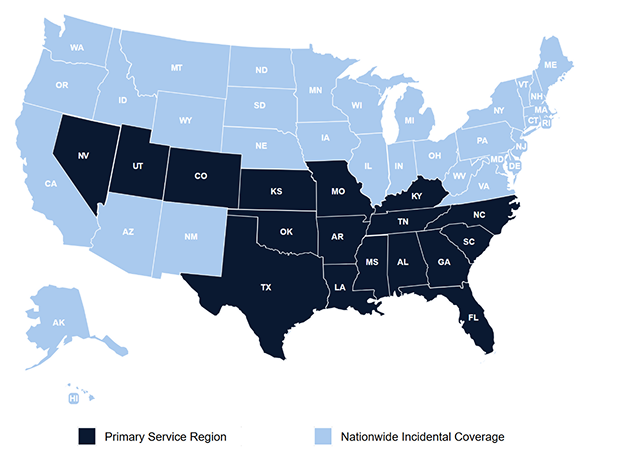

Primary Service Region with nationwide incidental coverage available for contractors and trades.

Choose the path that fits your needs. Whether you're exploring options, ready to schedule a call, or prepared to begin the onboarding process, we make getting started simple, clear, and comfortable.

T. Hudson Risk Advisors is licensed across the South and Southeast and can support incidental exposures nationwide for contractors and skilled trades.

Our primary service region is supported by active state licensing, with nationwide

incidental coverage available where permitted by law.

Choose the path that fits your needs. Whether you're exploring options, ready to schedule a call, or prepared to begin the onboarding process, we make getting started simple, clear, and comfortable.

T. Hudson Risk Advisors is an insurance advisory firm licensed across the South and Southeast, providing risk management and insurance solutions for organizations operating across multiple states. Our primary service region is supported by active state licensing, with nationwide incidental insurance coverage available where permitted by law and subject to carrier authorization and regulatory requirements.