Insurance audits can feel overwhelming—but they don’t have to. Our team stands

beside you throughout the entire process, ensuring accuracy, clarity, and effective

communication with auditors.

You are not alone in the audit process. We work directly with policyholders and auditors to

clarify exposures, provide documentation guidance, and protect your business from

incorrect audit outcomes.

A premium audit is a review of your financial and operational records to determine the

correct premium for Workers’ Compensation and General Liability policies. It typically

includes payroll, sales, subcontractor costs, and employee classifications.

We help prepare your records and communicate with auditors on your behalf.

Understanding First – We learn your operations and financial structure. Design & Placement – Policies structured accurately to avoid audit surprises. Ongoing Support – Managing estimates, classification updates, and renewal audits.

We review your bonding needs, financials, project pipeline, and goals.

We leverage our relationships to secure competitive rates, increased bonding limits, and

favorable terms.

We manage renewals, financial updates, and compliance documentation to maintain

bonding capacity.

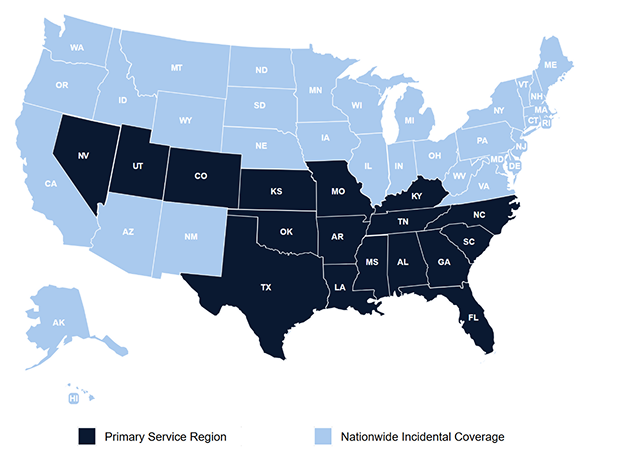

Primary Service Region with nationwide incidental coverage available for contractors and trades.

Choose the path that fits your needs. Whether you're exploring options, ready to schedule a call, or prepared to begin the onboarding process, we make getting started simple, clear, and comfortable.

T. Hudson Risk Advisors is licensed across the South and Southeast and can support incidental exposures nationwide for contractors and skilled trades.