Specialized Insurance Programs for Real Estate, Hospitality, Industrial, and Mixed-Use Assets

We combine insight, process, and responsiveness to deliver smarter coverage and measurable results. combining insights, process and responsiveness to deliver smarter covergae and measurable results

Deep understanding of tenant, infrastructure, and structural exposures.

COPE accuracy, replacement cost modeling, carrier-ready submissions.

Strong relationships with national and specialty property carriers.

Reduced claim severity, stronger compliance, stabilized premiums.

Comprehensive risk management solutions tailored to the unique challenges of real estate portfolios and property operations.

Strong partnerships are built on alignment, clarity, and trust. We work closely with owners,

managers, and developers to reduce risk and strengthen insurance stability.

We communicate proactively with you, your GC partners, your project managers, and your carriers to ensure seamless certificates, compliance, and claims support.

Entertainment Studios

Manufacturing Buildings

Multi-Family Residential

Self-Storage Facilities

Strip Malls

Hotels

Mixed-Use Properties

Office Buildings

Senior Living Communities

Warehouses

Industrial Buildings

Mini-Warehousing

Retail Buildings

Shopping Centers

We apply a disciplined, engineering-based approach to real estate risk—enhancing property resilience, improving underwriting outcomes, and stabilizing long-term portfolio

performance.

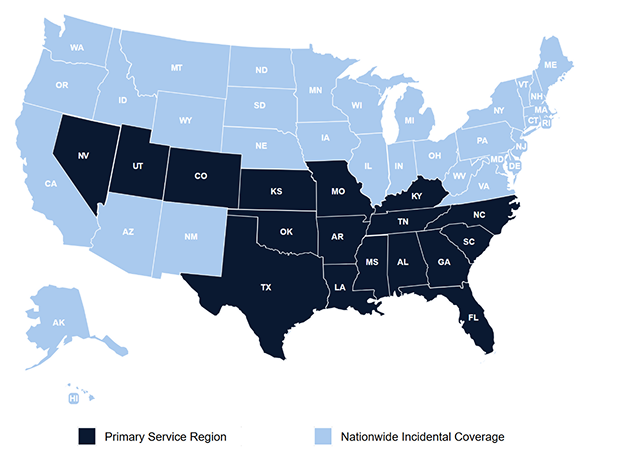

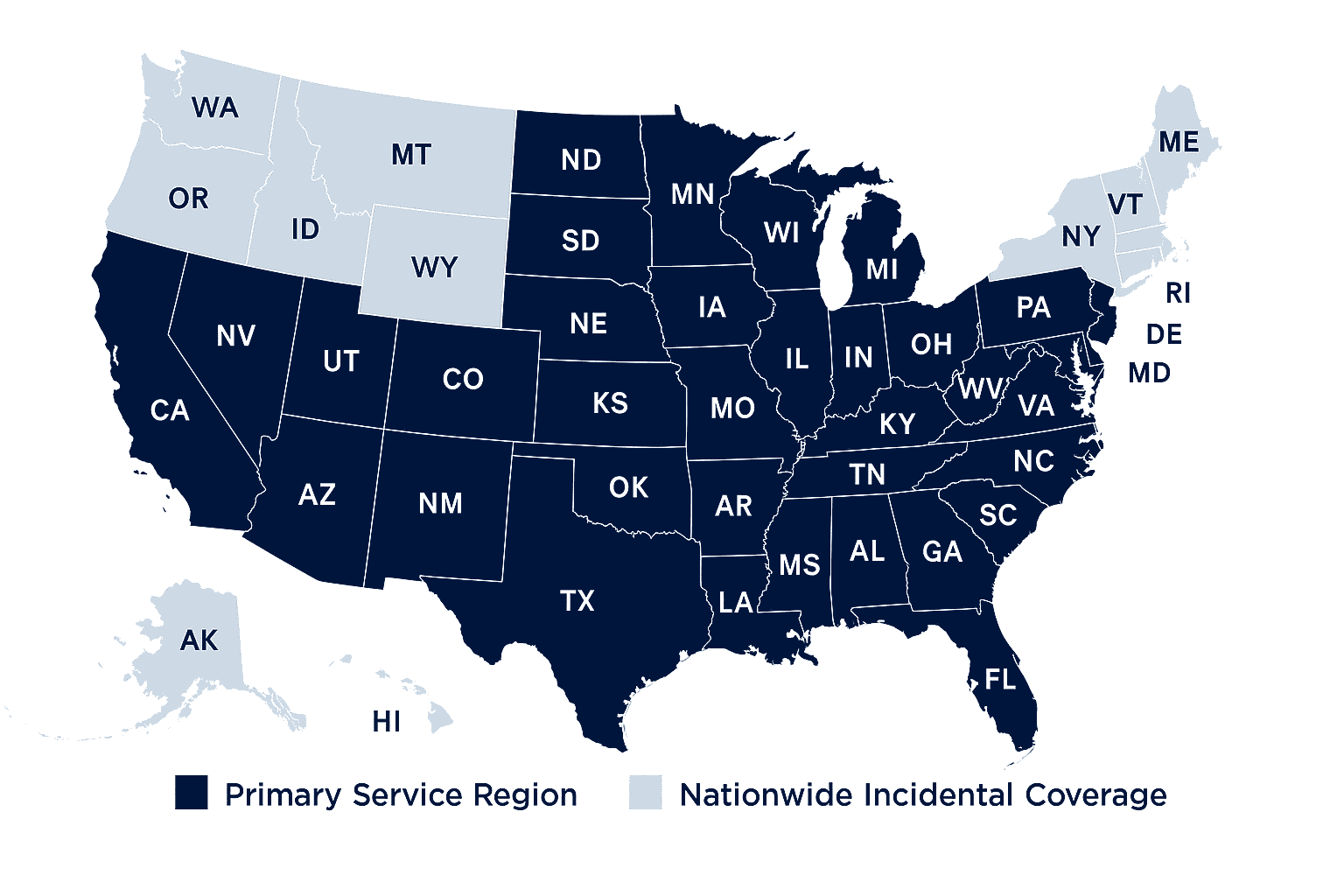

Our primary service region is supported by active state licensing, with nationwide

incidental coverage available where permitted by law.

Choose the path that fits your needs. Whether you're exploring options, ready to schedule a call, or prepared to begin the onboarding process, we make getting started simple, clear, and comfortable.

T. Hudson Risk Advisors is an insurance advisory firm licensed across the South and Southeast, providing risk management and insurance solutions for organizations operating across multiple states. Our primary service region is supported by active state licensing, with nationwide incidental insurance coverage available where permitted by law and subject to carrier authorization and regulatory requirements.

Primary Service Region with nationwide incidental coverage available for contractors and trades.

Choose the path that fits your needs. Whether you're exploring options, ready to schedule a call, or prepared to begin the onboarding process, we make getting started simple, clear, and comfortable.

T. Hudson Risk Advisors is licensed across the South and Southeast and can support incidental exposures nationwide for contractors and skilled trades.