Excess & Umbrella Liability Insurance for Businesses Across the Southeast

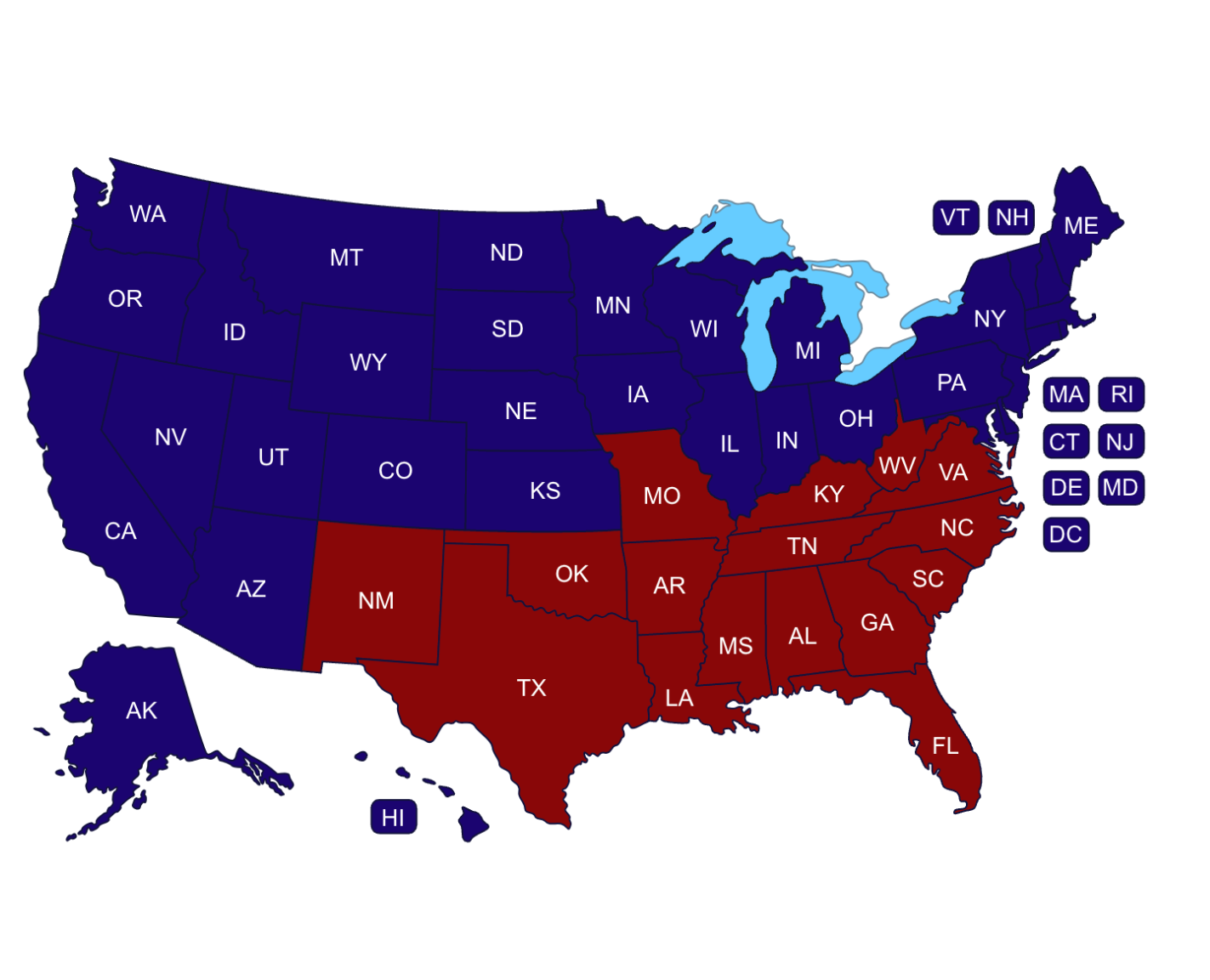

Protect your business with high-limit liability coverage designed to safeguard your assets, operations, and financial future from catastrophic claims. Our Excess & Umbrella Insurance programs support organizations throughout Georgia, Florida, Alabama, Tennessee, Texas, North Carolina, and South Carolina — with Georgia representing the core of our regional client base.

Excess & Umbrella Liability Insurance provides an additional layer of protection above your primary policies, including General Liability, Commercial Auto, and Employers Liability.

When a major claim exceeds the limits of your underlying coverage, an Umbrella or Excess Liability policy helps protect your business from financial devastation.

This coverage is essential for growing businesses in the Southeast facing larger contracts, higher liability exposure, or multi-state operations.

Companies operating in Georgia, Tennessee, the Carolinas, Florida, and Texas face rising lawsuit severity, increased settlement values, and expanding contract requirements.

An Excess or Umbrella policy protects your business from:

– Catastrophic liability claims

– High-value lawsuits

– Multi-vehicle or multi-injury accidents

– Claims that exceed underlying policy limits

– Contractual insurance limit requirements

– Large-scale property or auto-related losses

Without additional liability limits, one major incident can threaten your financial stability.

Excess & Umbrella Liability offers higher limits that sit above your underlying policies.

Coverage Extends Above:

– General Liability

– Commercial Auto Liability

– Employers Liability (Workers Compensation)

– Some Professional or Management Liability programs (when eligible)

Typical Losses Covered:

– Severe bodily injury claims

– Large property damage claims

– Multi-vehicle commercial auto accidents

– Customer or third-party lawsuits

– Catastrophic operational incidents

Businesses facing contractual requirements, high customer interaction, vehicle operations, or multi-state exposure need additional liability protection. We serve organizations across the Southeast in industries including:

– Construction & contractors

– Real estate & property management

– Manufacturing & industrial operations

– Staffing & hospitality firms

– Professional services organizations

– Technology & SaaS companies

– Healthcare & medical practices

– Retail, wholesale & distribution businesses

– Commercial fleet and transportation groups

Georgia, Texas, Florida, and North Carolina continue to see rising legal severity, making higher liability limits essential.

We design liability programs tailored to your business operations, contractual requirements, and exposure across state lines.

We analyze your current limits, exposures, and multi-state operations.

Coverage is structured around your industry, risk profile, and financial protection needs.

As your business grows, we adjust your liability limits to match contract requirements and increased exposure.

Companies across Georgia, Florida, Alabama, Tennessee, Texas, North Carolina, and South Carolina choose us because:

– We understand liability risks in high-growth industries

– Access to national carriers offering high-limit umbrellas

– Strong relationships with markets specializing in complex risks

– Fast quoting and contract-compliant limit recommendations

– Georgia-based leadership with regional reach and expertise

Primary Market:

– Georgia

Additional States Served:

– Florida

– Alabama

– Tennessee

– Texas

– North Carolina

– South Carolina

We support regional and multi-state businesses requiring coordinated liability protection.

One catastrophic claim should never threaten your company’s financial future. Get a tailored Excess & Umbrella Liability program built to protect your operations across the Southeast.